Deciding when to begin collecting Social Security depends on a number of factors, including how long you anticipate needing it.

Deciding when to retire and begin collecting Social Security is an important life decision. Some people may feel they don’t have enough savings to retire and delay their retirement plans to continue working, which means postponing when they begin collecting Social Security.

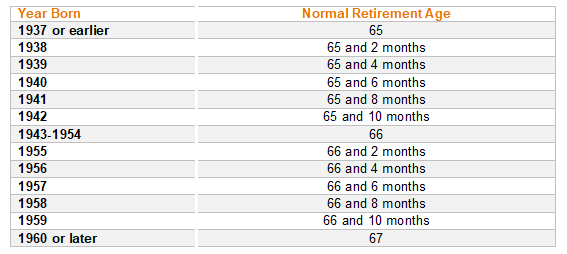

Current law allows workers to begin collecting Social Security between 62 and 70 years of age. The longer you delay retirement, the higher your monthly Social Security payout will be. That payout is based on your earnings history and the age at which you begin collecting payments—compared to what the government deems the normal retirement age (NRA), which depends on your birth year.

If you choose to begin collecting Social Security before your NRA, your monthly payments may be reduced by as much as 30%. Additionally, if you begin collecting early and you continue to earn income that exceeds the annual earnings limit, you will incur a penalty.

On the other hand, if you delay collecting Social Security until after your NRA, you will receive higher monthly payments. For each month past your NRA that you delay retirement, your monthly Social Security benefit will increase 0.29% if you were born between 1925 and 1942, and 0.67% if you were born after 1942.

So should you retire early, late, or exactly at your NRA? That depends on your financial situation and anticipated life expectancy. If you have a strong pension or hefty savings, you may wish to retire sooner.

If you have a family history of longevity, you will receive higher payments if you delay receiving benefits. For instance, if you think that you’re unlikely to live beyond 80, you may want to begin collecting Social Security at age 62. But if you expect to live longer than 82, you might consider delaying Social Security benefits.

Whenever you decide to begin collecting Social Security, remember that it represents roughly one-third of retirees’ income,1 according to the Social Security Administration. So you should consider other savings strategies to help support you when you decide to retire.