Education costs have skyrocketed over the last 10 years. As a parent, grandparent, or relative responsible for a child’s education, you know how critical meeting those costs will be to their future. We can help you navigate the complexities of college planning to pursue your unique savings and funding goals.

Education costs have skyrocketed over the last 10 years. As a parent, grandparent, or relative responsible for a child’s education, you know how critical meeting those costs will be to their future. We can help you navigate the complexities of college planning to pursue your unique savings and funding goals.

We are able to:

- Facilitate meaningful conversations about college planning and funding options with you, your child, and your extended family.

- Determine educational costs for public or private institutions and project future costs based on historical inflation.

- Establish savings goals and an appropriate savings rate.

- Determine the most suitable savings vehicle based on your present and future income, tax status, and need for control of the assets.

- Review your entire investment portfolio to ensure paying for college doesn’t impede your goals.

- Review distribution options such as using funds from your retirement or investment accounts, distributions from 529, UGMA/UTMA, or other investment accounts.

- Obtain information on how to apply for student loans and financial aid, insurance considerations, and more.

- Discuss basic financial planning and budgeting with your college-bound student.

Tax-Advantaged Education Savings Programs

- Uniform Gifts to Minors/Uniform Transfers to Minors Accounts (UGMA/UTMA)

- 529 College Savings Plan

- Coverdell Education Savings Account

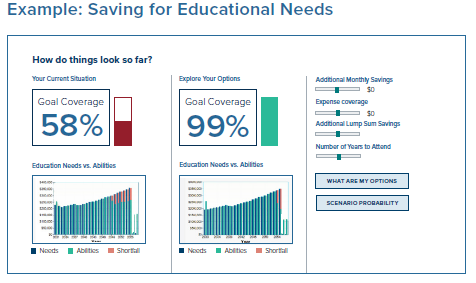

Through our financial planning process, we can help you understand if you are on track to meet your education savings goals and provide answers to these important questions:

- Which assets will be used to pay for a student’s—or multiple students’—education?

- What do the schools we are interested in cost?

- What must I save to pay for all or part of a student’s education?

- How much more should I be saving to best position myself to meet my college funding goal?

- Which accounts should I be using for college savings and how are these accounts taxed?

Let’s discuss your college savings and investing needs today, and we can help establish a plan to start saving or check-in on your progress to ensure you are on track to work towards your education savings goals! Contact us for more information.