IMPORTANT 2024 DATES, UNVEILING TAX BREAKS FOR HOMEOWNERS & TAX YEAR 2024 AND 2025 ADJUSTMENTS

The 2024 tax season is upon us, and it’s time to get prepared for filing your taxes. Whether you’re a seasoned taxpayer or a first-timer, understanding the key dates and procedures will help you navigate the process smoothly. Here’s a guide to help you through Tax Day 2024.

When Can I Start Filing My 2023 Tax Return?

The IRS has announced that the 2024 tax season will officially begin on January 29. This means that starting on this date, the IRS will start accepting and processing tax returns. If you’re eager to get a head start, using tax software allows you to enter the information you have before the official start date. Additionally, you can submit your tax paperwork to a tax professional ahead of time.

Employers are required to send W-2 and 1099 income tax forms to employees by the end of January. Ensure you check your mailbox regularly to receive these essential documents.

What’s the Deadline for Filing a 2023 Tax Return with the IRS?

The official deadline for filing federal tax returns for the 2023 tax year is Monday, April 15, 2024. It’s crucial to mark this date on your calendar to avoid any penalties or late fees. Be diligent in gathering all necessary documents and information to file your return accurately and on time.

Keep in mind that the IRS does offer extensions in case of unforeseen circumstances. If you’re serving abroad in the military, you may be granted additional time to file.

Deadline for Tax Extension

If you find yourself needing more time to complete your tax paperwork, April 15 is also the deadline to file a tax extension with the IRS. However, it’s essential to note that getting an extension doesn’t change the payment deadline. You must still submit any amount you owe on time to avoid late penalties. The extension provides until October to complete the necessary paperwork.

When Can I Expect My Refund?

For those filing electronically and expecting a refund, the IRS states that it typically takes around 21 days to process refunds. This timeline applies to those who opt for direct deposit and have no issues with their return.

By law, the IRS must wait until mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. If you fall into this category and use direct deposit with no other issues, you can anticipate receiving your refund by February 27, 2024.

State Taxes and Other Considerations

While a majority of states follow the federal government’s tax timetable, some have their own schedule. It’s essential to be aware of your state’s specific deadlines and requirements for filing state taxes.

As Tax Day approaches, staying organized and informed will ensure a smooth filing process, allowing you to meet deadlines and make the most of any potential refunds.

Unveiling the Tax Breaks for Homeowners

Owning a home comes with numerous responsibilities, but it also offers a range of tax breaks that can contribute to a more substantial tax refund. As we delve into the intricate world of homeowner tax breaks, we’ll explore how they work and highlight some key points to help you make the most of these deductions and credits.

How Do Homeowner Tax Breaks Work?

Most tax breaks for homeowners are in the form of deductions, reducing your taxable income. By minimizing the portion of your income subject to taxation, you ultimately pay less in taxes. When filing your tax return, you face the decision of taking the standard deduction or itemizing deductions, such as charitable contributions and state taxes. To benefit from homeowner tax deductions, you’ll typically need to itemize using Form 1040 Schedule A.

Tax credits for homeowners, on the other hand, directly reduce the amount of taxes you owe, and they don’t necessarily require you to itemize. This distinction is crucial, as it provides homeowners with various avenues to optimize their tax situation.

Exploring Key Homeowner Tax Breaks

1. Mortgage Interest Deduction

One of the most significant tax breaks for homeowners is the deduction of mortgage interest. By itemizing, you can reduce your taxable income by the interest paid on your mortgage.

2. Mortgage Points Deduction

Mortgage points, paid upfront to lower your mortgage interest rate, are also tax-deductible. This deduction can lead to additional savings for

homeowners.

3. New Homeowner Tax Credit

First-time homeowners may qualify for a tax credit related to mortgage interest payments, providing substantial financial benefits in the early years of homeownership.

4. Property Tax Deduction

Homeowners can deduct property taxes paid on their primary residence, offering relief from the burden of local property taxes. However, there is a cap on the amount that can be deducted.

5. Home Office Expenses

If you’re self-employed, you may deduct expenses related to a home office. This includes a portion of your utilities, insurance, and mortgage interest.

6. Electric Car Charging Station Credit

Installing an electric car charging station at home may qualify you for a 30% tax credit, promoting eco-friendly practices.

7. Energy-Efficiency Tax Credits

In 2024, energy-efficient improvements may yield more significant tax credits, encouraging homeowners to invest in environmentally friendly

upgrades.

8. Home Equity Loan Interest Deduction

Interest paid on home equity loans may also be tax-deductible, providing relief for those leveraging their home equity.

9. Including Improvements in Cost Basis

When selling your home, including all improvements in the cost basis can reduce your capital gains tax.

10. Tax Deduction for Home Sales

Selling your primary residence may qualify you for a substantial tax deduction, further incentivizing homeownership.

11. Home Improvements for Medical Needs

Certain home improvements made for medical reasons may be tax-deductible, providing assistance for necessary modifications.

Home Expenses That Aren’t Tax Deductible

Despite the array of tax breaks available, some home-related expenses cannot be deducted from your income. These include your down payment, mortgage payments toward the loan principal, utility costs, homeowner’s insurance, house cleaning, lawn maintenance, and any depreciation of your home’s value.

Remember, everyone’s tax situation is unique. Before making major tax decisions, consulting atax professional is recommended. They can guide you through federal and state tax laws, helping you make informed choices on your tax benefits. As you navigate the complexities of homeowner tax breaks, seize the opportunities available to work toward enhancing your financial well-being.

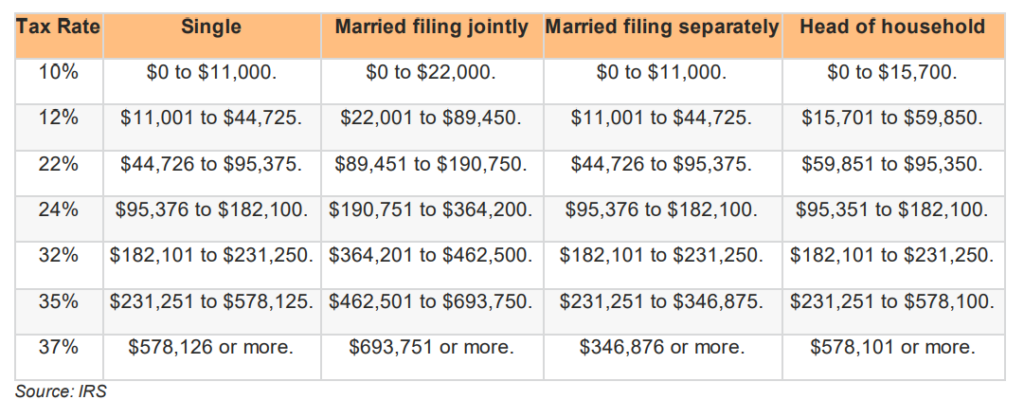

Tax Brackets 2023

You pay tax as a percentage of your income in layers called ta brackets. As your income goes up, the tax rate on the next layer of income is higher. When your income jumps to a higher tax bracket, you don’t pay the higher rate on your entire income. You pay the higher rate only on the part that’s in the new tax bracket.

2023 tax rates for a single taxpayer (taxes filed in 2024)

For a single taxpayer, the rates are:

Changes Coming for 2025

From the IRS: “The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025. The tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts:

- The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

- Marginal rates: For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

The other rates are:

- 35% for incomes over $243,725 ($487,450 for married couples filing jointly)

- 32% for incomes over $191,950 ($383,900 for married couples filing jointly)

- 24% for incomes over $100,525 ($201,050 for married couples filing jointly)

- 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

- 12% for incomes over $11,600 ($23,200 for married couples filing jointly)

The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

- The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom the exemption began to phase out at $1,156,300).

- The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax year 2023. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

- For tax year 2024, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $315, an increase of $15 from the limit for 2023.

For the taxable years beginning in 2024, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $640, an increase of $30 from taxable years beginning in 2023.

Your Financial Professional

A financial professional can play pivotal role in guiding individuals towards making informed and strategic decisions about their money, potentially placing a special emphasis on tax planning and preparation.

As financial landscapes continue to evolve and tax regulations become increasingly complex, the guidance of a knowledgeable financial professional becomes indispensable. Your financial professional serves as a beacon of financial wisdom, helping you navigate the intricate maze of tax planning with the overarching goal of improving your financial well-being.

One of the key areas where your financial professional can prove their worth is during the crucial stages of tax planning and preparation. With the turn of the year, individuals have the opportunity to reassess their financial standing, evaluate potential tax liabilities, and implement strategies aimed at minimiz ing tax burdens. In this context, a financial professional can become a valued partner, offering insights into the ever-changing tax code, identifying relevant deductions, and devising customized approaches to help clients take full advantage of available credits and exemptions.

Beyond the tactical aspects of tax planning, a financial professional may contribute significantly to fostering a sense of security and confidence. In an era marked by financial uncertainties, having an experienced financial professional may offer reassurance that financial decisions are being made with diligence and foresight. Your financial professional’s role may extend beyond reactive measures to proactively shaping a financial strategy aligned with your unique circumstances and long-term objectives. Through their expertise, your financial professionals can help empower you to not only navigate tax complexities but also to chart a course towards financial prosperity and stability.

The information contained in this newsletter is for general use, and while we believe all information to be reliable and accu rate, it is important to remember individual situations may be entirely different. The information provided is not written or intended as tax or legal advice and may not be relied on for p urposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. This newsletter is written and published by Financial Media Exchange, Plymouth MA. Copyright © 2023 Financial Media Exchange LLC.,. All rights reserved. Distributed by Financial Media Exchange.

Important Disclosures

Content in this material is for educational and general information only and not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completenes s or accuracy.

This article was prepared by Financial Media Exchange LLC.

Tracking #535405